House Insurance Australia Home Insurance 101

So you’ve finally done it! You’ve saved up enough money to buy your own house! Congratulations! It’s an exciting time, but now that you’re a homeowner, you have to start thinking about protecting your investment. That’s why I want to talk to you about house insurance.

What is House Insurance?

House insurance, also known as home insurance, is a type of insurance that covers your home and its contents in case of damage or loss. It generally covers three main things:

- Structural damage to your home

- Destruction of personal property

- Liability for injuries caused to others on your property

Now that you know what house insurance is, let’s talk about how to choose the right insurance for your needs.

Choosing the Right Insurance

The first thing you should do when choosing house insurance is to shop around. There are many insurance companies out there, and each one offers different coverages and prices. It’s important to compare policies from several different insurers before making a decision.

When comparing policies, there are a few things you should pay attention to:

- Coverage Limits: The coverage limit is the maximum amount the insurer will pay for damages or loss. Make sure the coverage limits are sufficient to cover the cost of rebuilding your home and replacing your personal belongings.

- Deductibles: The deductible is the amount you’ll have to pay out of pocket before the insurance kicks in. Generally, higher deductibles mean lower premiums, but make sure you can afford the deductible in case of a claim.

- Exclusions: Make sure you understand what is and isn’t covered by the policy. Some policies exclude certain types of damage, such as flood or earthquake damage.

- Additional Coverages: Some policies offer additional coverages, such as identity theft protection or coverage for home businesses. Make sure you understand what additional coverages are available and whether you need them.

- Customer Service: Finally, make sure you choose an insurer with good customer service. You don’t want to be stuck dealing with a difficult insurer if you need to file a claim.

Tips for Reducing Premiums

House insurance premiums can be expensive, but there are a few things you can do to reduce your premiums:

- Improve Security: Adding security features such as deadbolts, security systems, and smoke detectors can reduce the risk of theft or damage, which can lead to lower premiums.

- Bundling: Many insurers offer discounts if you purchase multiple policies from them, such as house and car insurance.

- Higher Deductibles: As mentioned earlier, higher deductibles can lead to lower premiums. Just make sure you can afford the deductible if you need to file a claim.

- Maintain Good Credit: Many insurers take credit scores into account when determining premiums. Maintaining good credit can lead to lower premiums.

- Comparison Shop: Finally, make sure you shop around and compare policies from multiple insurers. You may find a better deal with a different insurer.

How to File a Claim

If you need to file a claim, there are a few steps you should follow:

- Contact Your Insurer: Contact your insurer as soon as possible after the damage or loss occurs to report the claim.

- Provide Documentation: Provide documentation of the damage or loss, such as photos or receipts.

- Meet with an Adjuster: Your insurer will likely send an adjuster to assess the damage and determine the value of the claim.

- Receive Payment: If the claim is approved, you’ll receive payment from your insurer.

Now that you know more about house insurance, I hope you feel more confident in choosing the right insurance for your needs. Remember to compare policies from multiple insurers, pay attention to coverage limits and deductibles, and consider additional coverages that may be available. With the right insurance, you can protect your investment and enjoy your new home with peace of mind.

Who knew that owning a home required so much thought? Now that you’ve got the house insurance taken care of, here are a few other things to consider:

Home Maintenance Tips

Maintaining your home can help prevent damage and keep your home in good condition. Here are some tips for home maintenance:

- Clean Gutters and Downspouts: Clean gutters and downspouts regularly to prevent water damage from improper drainage.

- Check for Leaks: Check for leaks around windows, doors, and plumbing fixtures. Fixing leaks can prevent water damage and save money on your water bill.

- Test Smoke Detectors: Test smoke detectors regularly to make sure they’re working properly. Replace batteries as needed.

- Trim Trees and Shrubs: Trim trees and shrubs away from your home to prevent damage from falling branches.

- Replace HVAC Filters: Replace filters in your HVAC system regularly to improve air quality and reduce energy costs.

- Clean Dryer Vents: Clean dryer vents regularly to prevent dryer fires.

Conclusion

Now that you’re a homeowner, it’s important to protect your investment with house insurance. By comparing policies from multiple insurers and paying attention to coverage limits and deductibles, you can choose the right insurance for your needs. Don’t forget to consider additional coverages that may be available, such as identity theft protection or coverage for home businesses. And remember to maintain your home to prevent damage and keep it in good condition. Congratulations on your new home!

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal or financial advice. This article contains links to third-party websites, and I am not responsible for the content or accuracy of those websites. Please consult a licensed professional for advice specific to your situation.

If you are searching about Lesson: Home Insurance 101 – Benchmark you’ve came to the right web. We have 9 Pictures about Lesson: Home Insurance 101 – Benchmark like Is House Insurance Worth Buying? 7 Points To Justify, House Insurance – House Insurance Cost | House Insurance Companies and also Lesson: Home Insurance 101 – Benchmark. Read more:

Lesson: Home Insurance 101 – Benchmark

benchmark.us

insurance benchmark lesson

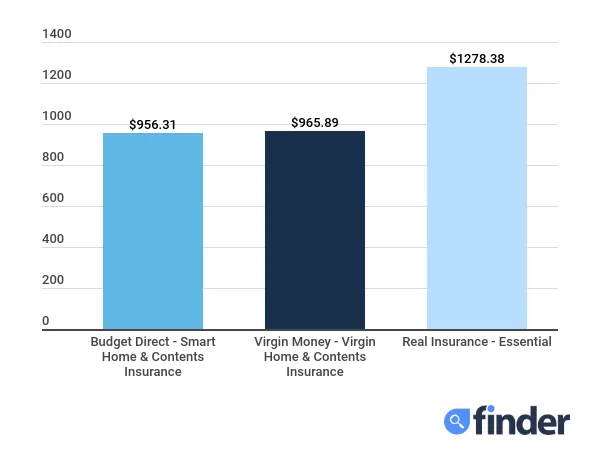

Home And Contents Insurance SA | Compare Policies Online

www.finder.com.au

Is House Insurance Worth Buying? 7 Points To Justify

searchfrog.com.au

justify

Home Insurance Quotes, Ireland – Compare Cheap House Policies

www.pembrokeinsurances.ie

insurance house

Home Insurance | Choosing The Right Insurance | ABI

www.abi.org.uk

abi policies

Perth Insurance Brokers & Risk Managers

wainsurancebrokers.com.au

insurance house perth brokers risk au

3 Things To Consider If You’re Denied A Mortgage – Prime Credit Advisors

www.primecreditadvisors.com

insurance denied mortgage if consider things house re

Home Insurance 101 – Part 1

www.consumerinsuranceservicesinc.com

homeowners

House Insurance – House Insurance Cost | House Insurance Companies

www.tecreals.com

House insurance. Insurance denied mortgage if consider things house re. Insurance house perth brokers risk au

Honda Stylo 160 ABS

Honda Stylo 160 ABS Honda BeAT Deluxe CBS-ISS

Honda BeAT Deluxe CBS-ISS Honda Vario 125

Honda Vario 125 Honda Vario 160 ABS

Honda Vario 160 ABS Honda ADV 160 ABS

Honda ADV 160 ABS Honda PCX 160 CBS

Honda PCX 160 CBS

Tidak ada komentar